NWO veni project 2024-2028 ‘Philosophy of Taxation’

Keywords

taxation, distributive justice, income inequality, wealth inequality

Updates

Special issue

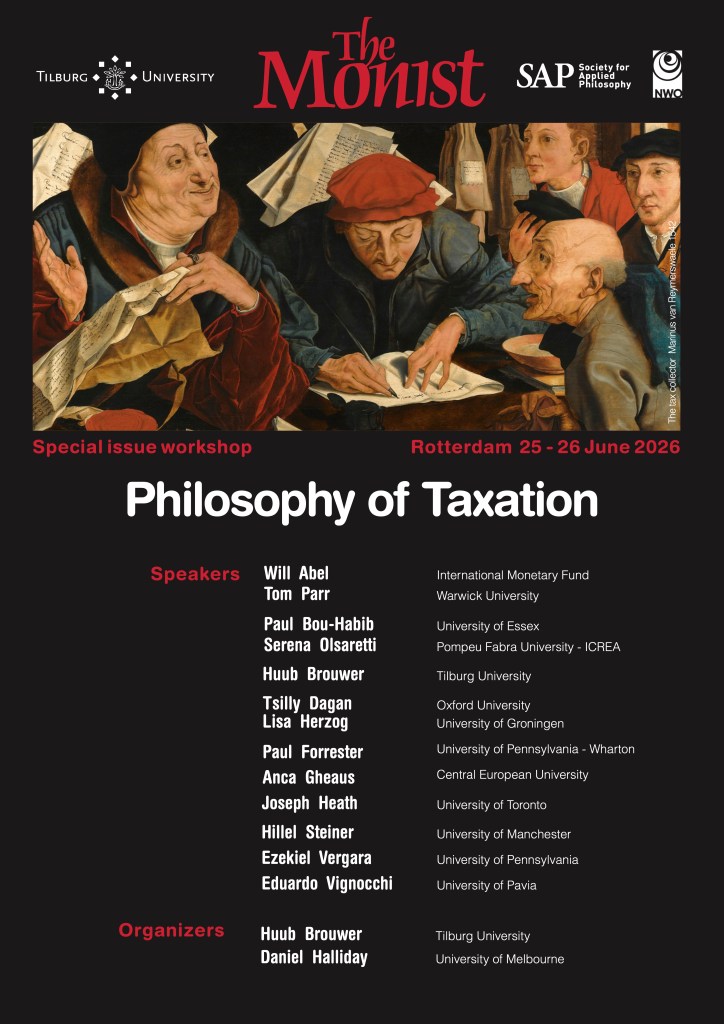

Dan Halliday and I are editing a special issue of the Monist on philosophy of taxation.

We had a call for abstracts for a workshop in Rotterdam on 25-26 June 2026, which is now closed. All papers presented at the workshop will be considered for inclusion in the special issue. The issue will be published in April 2028.

The workshop is funded by Brouwer’s Veni grant on philosophy of taxation and the Society for Applied Philosophy.

Summer school

Dan Halliday and I are organizing a Phd summer school on Ethics and Economics, from 22-24 June 2026, In Rotterdam.

We will focus on climate change, labor markets, and taxation. There will be 12 lectures by leading researchers on these themes. Registrations are processed on a rolling basis. The last date to register is 31 March 2026. You can register here.

The summer school is administered by the Dutch Research School for Philosophy (OZSW). It is financially supported by the OZSW and Huub Brouwer’s Veni grant on philosophy of taxation.

Academic publications

Forthcoming. “Verdelende rechtvaardigheid.” In Basisboek Ethiek, edited by Romy Eskens, Jeroen Hopster, Benjamin de Mesel, Thomas Nys. Den Haag: Boom uitgeverij.

Forthcoming. “The Ethics of Selling Shares in Your Future Income.” Politics, Philosophy & Economics, with Friedemann Bieber. https://doi.org/10.1177/1470594X251391208. Available in open access.

2026. “The Normative Case for a Global Minimum Tax on Ultra-High-Net-Worth Individuals.” Intertax 54(1), with Ingrid Robeyns. https://doi.org/10.54648/taxi2026002. Author accepted manuscript here.

2026. “The Empirical Premises of Economic Limitarianism.” In Why Political Theory Needs Empirical Social Science, edited by Alice Baderin and David Miller. Oxford: Oxford University Press, with Ingrid Robeyns. Author accepted manuscript here.

2024. “The Future of the Philosophy of Work.” Journal of Applied Philosophy 41(2), 181-201, with Markus Furendal and Willem van der Deijl-Kloeg. http://doi.org/10.1111/japp.12730. Available in open access.

Publications aimed at a wider audience

10.07.2025. “Rijker en gelijker? Laten we de roze bril afzetten.” Opinion piece for de Volkskrant.

08.05.2025. “Position paper for roundtable in Netherlands House of Representatives on wealth inequality and taxation.” Available in open access.

Debate organizing and moderating

19.01.2026. “Hoe AI alle banen verandert.” Speakers: Anna Salomons, Bas Haring, Neele Boerens, Tim Christiaens, Sita Struijke. Arminius Rotterdam, with Nederlands Gesprek Centrum and Koninklijke Vereniging voor Staathuishoudkunde, and NWO project Philosophy of Taxation (VI.Veni.221F.045).

15.05.2025. “Kan de overheid het goed doen? Over maatwerk in beleid.” Speakers: Marije Huiting, Ruth Kanis, Daan de Kort, Mariëtte Patijn, Marieke Thoomes, Will Tiemeijer. Arminius Rotterdam, with Nederlands Gesprek Centrum, Koninklijke Vereniging voor Staathuishoudkunde, and NWO project Philosophy of Taxation (VI.Veni.221F.045).

26.03.2025. “De grote ongelijkmaker? Over erven en schenken.” Speakers: Céline van Essen, Mascha Hoogeveen, Nicole Gubbels, Luc Stultiens, Dick Timmer, Wendy van Eijk-Nagel, Marcel Wissenburg. Arminius Rotterdam, with Nederlands Gesprek Centrum, Koninklijke Vereniging voor Staathuishoudkunde, and NWO project Philosophy of Taxation (VI.Veni.221F.045).

23.10.2024 “Fossiele subsidies afschaffen: no brainer?” Speakers: Herman Vollebergh, Heleen de Coninck, Silvio Erkens, Suzanne Kröger, and Chris Julien. Arminius Rotterdam, with Nederlands Gesprek Centrum, Koninklijke Vereniging voor Staathuishoudkunde, and NWO project Philosophy of Taxation (VI.Veni.221F.045).

07.02.2024. “Een bovengrens voor rijkdom.” with speakers Ingrid Robeyns, Arjan Lejour, Wouter Schakel, Tazuko van Berkel. Moderation by Huub Brouwer and Robert Dur. Arminius Rotterdam, with Nederlands Gesprek Centrum, Koninklijke Vereniging voor Staathuishoudkunde, and NWO project Philosophy of Taxation (VI.Veni.221F.045).

Research stays

08.04.2024 – 15.06.2024. Research visit to Wolfson College and Faculty of Philosophy, Oxford. Host: Jonathan Wolff.

Presentations, academic

03.11.2025. “Can Capital Income be Deserved?” KantianDESERT launch conference, University of Liverpool.

04.04.2025. “Tax Cuts for Socially Valuable Work.” Political Philosophy in a Changing World of Work workshop, Pompeu Fabra University.

13.07.2024 “The Ethics of Selling Shares in Yourself.” Joint Session, University of Birmingham.

29.05.2024 “The Ethics of Selling Shares in Yourself.” Ethics Institute colloquium, University of Zürich (online).

01.03.2024. “Can Investment Income be Deserved?”. Presentation at URPP Interdisciplinary Conference: Taxation and Inequality, University of Zürich.

Presentations, wider audience

11.02.2026. Column: extreme wealth (‘Column over extreme rijkdom’). Tafel van Martinus, Schouwburg, Tilburg.

05.11.2025. Keynote on wealth limits at the launch of the 2025 yearbook of poverty and inequality. Universitaire Stichting Armoedebestrijding, Antwerp.

13.05.2025. “Contribution to roundtable in Netherlands House of Representatives on wealth inequality and taxation.” Tweede Kamer, Den Haag.

26.02.2024. Five Misunderstandings about Merit (‘Vijf misverstanden over verdienste’). Filosofisch café, Utrecht.

Organizing

30.04.2025. “Fixing the Distributive Bias in the Credit System.” Co-organised a lunch seminar at the Fiscal Institute Tilburg (FIT) with speaker Daniel Halliday (University of Melbourne)

14.02.2024. “Fairness in the Choice of Tax Base: On the justification of a general consumption tax.” Co-organised a lunch seminar at the Fiscal Institute Tilburg (FIT) with speaker Bruno Verbeek (Leiden University).